Information last updated August 4th, 2023

Inflation Reduction Act Tax Credits

Maximize your savings with home efficiency updates.

The Inflation Reduction Act (IRA) makes energy-efficient home upgrades simple and more affordable. A more efficient home can reduce your energy costs, lower carbon emissions and improve your family’s comfort. OPPD is your trusted resource for IRA tax credits, helping you make informed decisions and connecting you with OPPD-certified Trade Allies who can complete your updates.

Always refer to a trusted tax professional for personal advice and eligibility on any tax credit.

WHY UPGRADE?

New energy-efficient technologies are safer, use less power, and are more affordable, thanks to the IRA. They can even help lower utility bills, reducing your overall energy costs. Ready to upgrade your home with a new heat pump, central air-conditioner, or solar panels? Locate a Trade Ally today.

*Credit amounts/limits are subject to change. Verify current information with the IRS Inflation Reduction Act page, and consult with an OPPD-certified Trade Ally before making any final decisions.

More About IRA Residential Tax Credits

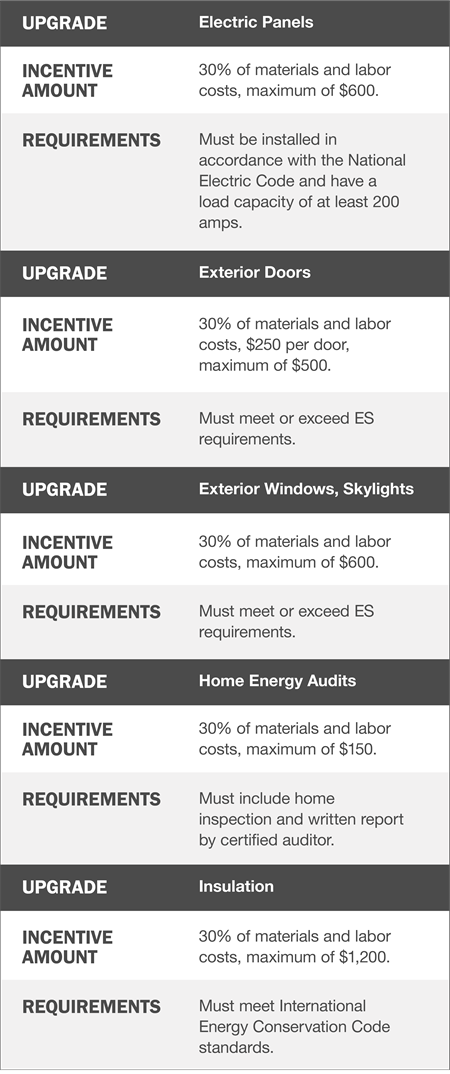

Most IRA credits allow you to claim 30% of installation costs on certain energy-efficient home upgrades as dollar-for-dollar reductions on your taxes that year. You can only claim so much per year, but many credits will be available to claim for several years (some until 2031) and can be claimed multiple times for qualifying work performed during the tax-year.

The categories below provide a basic overview of the currently available credits. Always consult with your tax professional about your eligibility for credits on specific upgrades you’d like to make for your home.

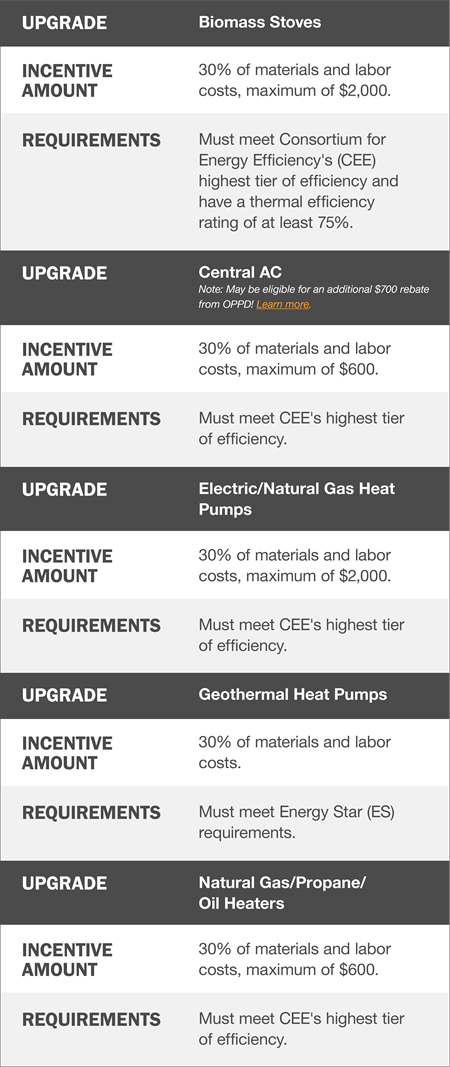

Heating & Cooling Upgrades

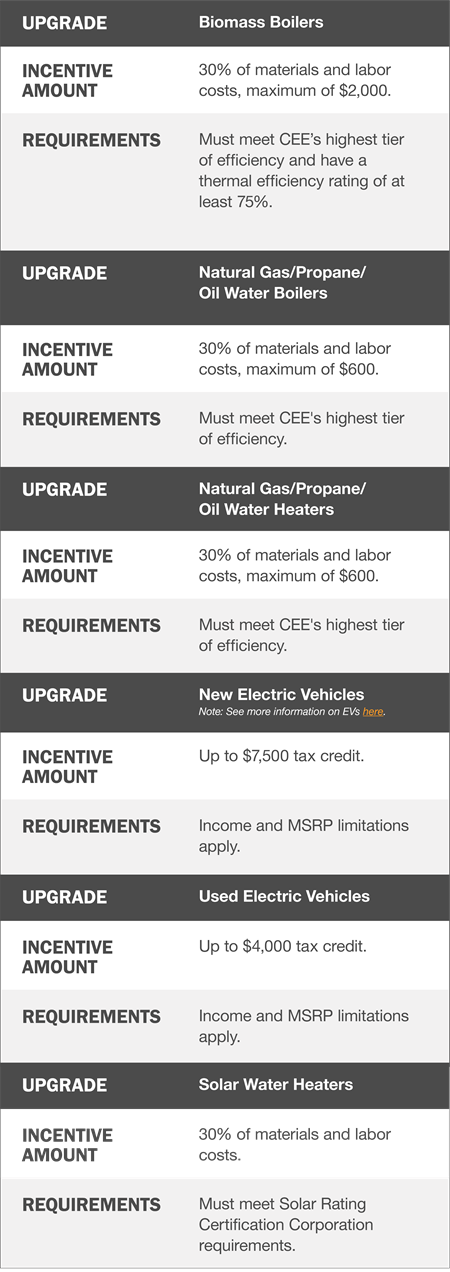

Upgrading your home's HVAC system or water heater can result in big savings on your energy bill. Some modern heating/cooling equipment (like heat pumps) are 2-3 times more efficient than 20th-century climate-control solutions.

The IRA offers homeowners with energy-efficiency tax credits on qualifying new central A/C units, water heaters, furnaces, boilers and heat pumps. OPPD also has HVAC Smart Rebates available to help you offset the up-front costs of upgrading home’s efficiency.

Electric Vehicles

Most people are most interested to learn if there will be tax credits for electric vehicles. The answer is: yes! Qualifying households may be eligible to claim up to $7,500 on a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) and up to $4,000 on used EVs.

Check out OPPD’s Guide to Electric Vehicles to learn more about EVs in the Omaha area, and for advice on selecting the right vehicle for your lifestyle!

Home Exterior Efficiency Upgrades

Your home develops drafts as it ages from settling and general wear—and simple repairs can only go so far. IRA tax credits are available that help reimburse homeowners for making energy-efficient upgrades to their insulation, windows, and exterior doors. Not only can this help reduce your energy costs by 10-20%, but you’ll enjoy more comfortable indoor spaces that are easier to keep at a consistent temperature.

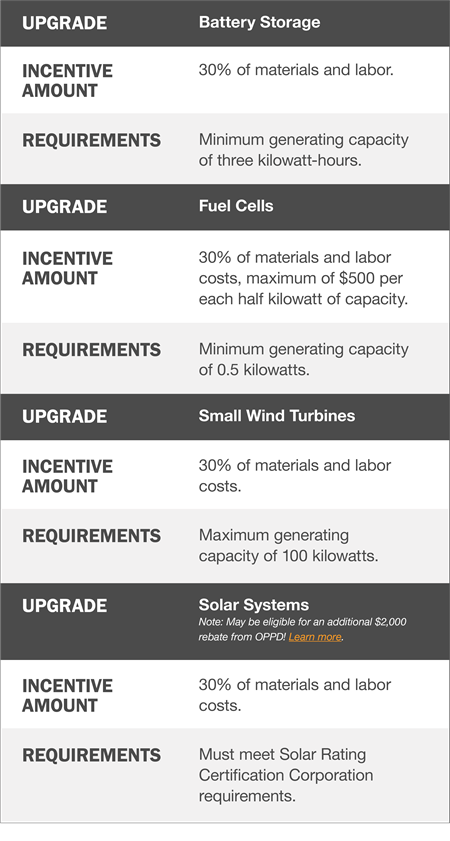

Clean Energy Generation & Storage

Home solar is becoming more reliable and realistic every year and the IRA tax credits make it easier than ever for the average homeowner offset their everyday energy cost with clean energy. Solar panels and wind turbines provide renewable power with home batteries to store them. Excess energy? OPPD’s net-metering program allows you to sell back your clean surplus and earn credits to reduce your bill.

Offset your energy costs by generating power through systems like solar panels or wind turbines. If you generate more than your home needs, you can store it in a home battery backup system or earn money by selling it to OPPD through our net-metering program. OPPD also has Solar Rebates available to help you offset the up-front costs of home solar.

IRA Resources

Learn more about the IRA and its included upgrades by exploring the following sources:

Department of Energy IRA FAQ

EnergyStar IRA Homeowner Tax Credit Guide

Internal Revenue Service IRA FAQ

Rewiring America

Text of the Inflation Reduction Act

Still Have Questions?

You can always email customerservice@oppd.com or call 402-536-4131.