Information last updated October 27, 2025

Inflation Reduction Act Tax Credits

![]()

Important Update: Changes to Inflation Reduction Act

The information below may have changed recently due to updates from the One, Big, Beautiful Bill Act (OBBB). Check for the latest information here.

Maximize your savings with home efficiency updates.

The Inflation Reduction Act (IRA) helps homeowners make energy-efficient home upgrades simple and more affordable. A more efficient home can reduce your energy costs, lower carbon emissions and improve your family’s comfort. OPPD is here to help you make informed decisions about the new IRA tax credits and connect you with OPPD-certified Trade Allies who can complete your updates.

Always refer to a trusted tax professional for advice on your personal tax credit decisions.

WHY UPGRADE?

New energy-efficient technologies are safer, use less power and are now more affordable than ever thanks to Inflation Reduction Act tax credits. And a more efficient home means you’ll use less energy, helping lower your energy costs for years to come.

*Credit amounts/limits are subject to change. Verify current information with the IRS Inflation Reduction Act page, and consult with an OPPD-certified Trade Ally/your tax advisor before making any final decisions.

Keep scrolling for more about geothermal tax credit, clean energy tax credit, solar investment tax credit, clean vehicle tax credit and wind tax credit opportunities.

More About IRA Residential Tax Credits

Inflation Reduction Act legislation allows you to claim up to 30% of costs on certain energy-efficient home upgrades as dollar-for-dollar reductions on your taxes that year. You can only claim so much per year, but many credits will be available to claim for several years (some until 2031) and may be claimed multiple times for any qualifying work performed during each tax-year.

The categories below provide a basic overview of currently available credits. Always consult with a tax professional about your eligibility for credits on any specific upgrades you’re interested in making to your home.

Energy-Efficient Heating & Cooling Upgrades

Upgrading your home's HVAC system or water heater can result in big savings on your energy bill. Some modern heating/cooling equipment (like heat pumps) are 2-3 times more efficient than 20th-century climate-control solutions.

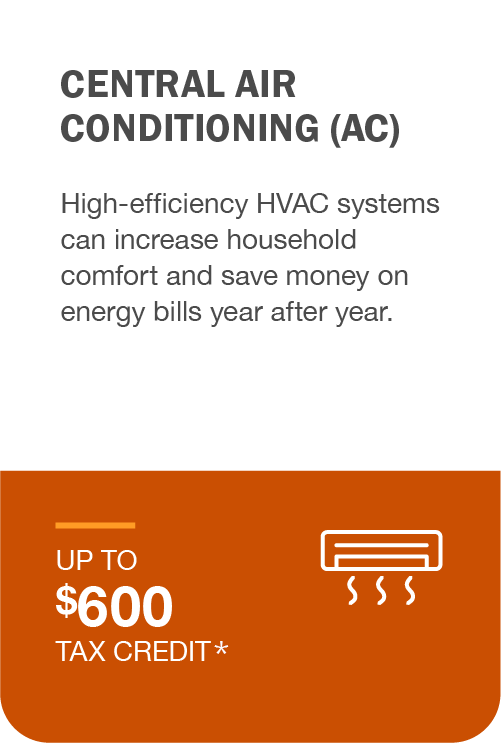

The IRA offers homeowners with energy-efficiency tax credits on qualifying new central A/C units, energy-efficient water heaters, heat pump water heaters, furnaces and boilers. There’s also federal geothermal tax credits for geothermal heat pumps. Don’t forget about OPPD HVAC Smart Rebates (including geothermal rebates), which can offset some of the up-front costs of making these upgrades.

Energy Efficient Home Improvement Credits are scheduled to expire after December 31, 2025. For more information, click here.

Home Exterior Efficiency Upgrades

Your home develops drafts from settling and general wear as it ages —and simple repairs can only go so far. The energy-efficient home improvement credit group helps reimburse homeowners for making energy-efficient upgrades to insulation, adding energy efficient windows and replacing exterior doors. Not only can this help reduce your energy costs by 10-20%, but you’ll enjoy more comfortable indoor spaces that are easier to keep at a set temperature.

Looking to upgrade windows or attic insulation with IRA tax credits? OPPD can also help you offset start-up costs on certain projects with our Weatherization Rebates, saving you even more money on these valuable energy-saving upgrades!

*Window tax credit also applies to skylights

Energy Efficient Home Improvement Credits are scheduled to expire after December 31, 2025. For more information, click here.

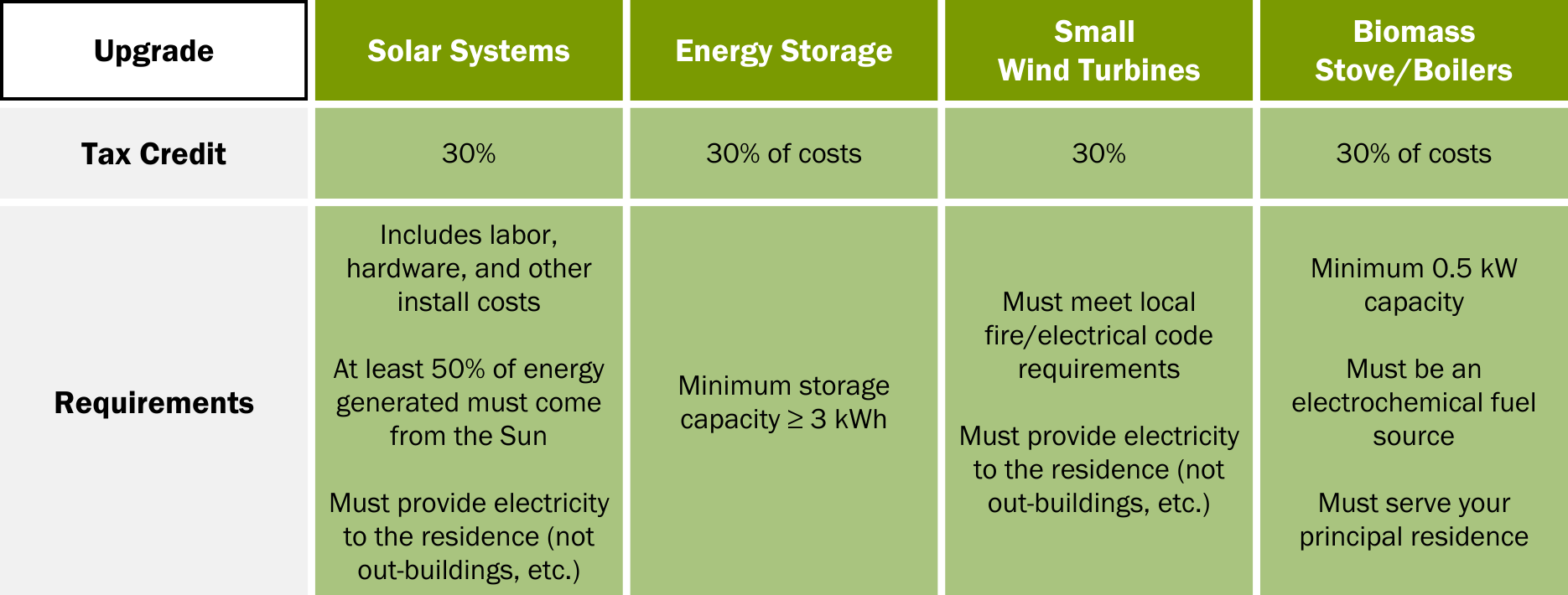

Clean Energy Generation & Storage

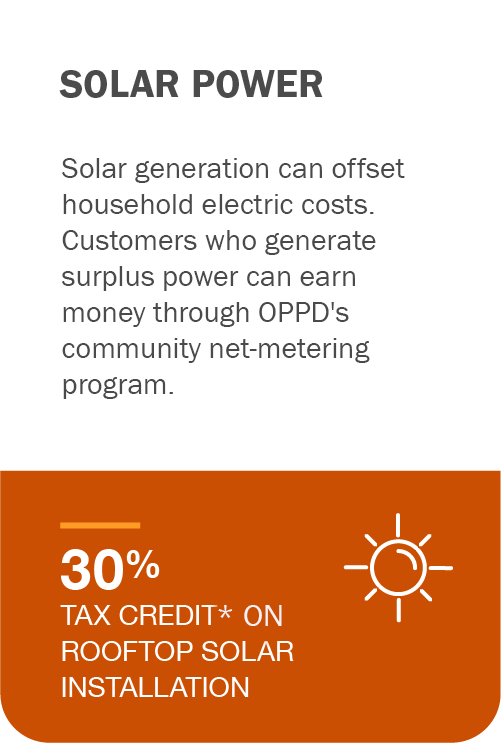

Home solar is becoming more reliable and realistic every year. Taking advantage of the residential clean energy credit makes it easier than ever for the average homeowner to make some of their everyday energy come from clean generation. The Inflation Reduction Act solar tax credit has provisions to add solar panels and wind turbines to your home to generate renewable power — as well as backup batteries to store that power.

OPPD Solar Rebates can help you save even more on upfront costs while OPPD's Net Metering program allows you to earn money selling back any surplus solar energy. Find answers to all your solar questions on our Customer-Owned Generation homepage.

More About IRA Annual Caps/Limits

IRA Credits are subject to a total annual cap of $3,200. Most upgrades have an individual cap for how much you can claim but can be combined with other upgrades up to a certain limit:

- Windows/doors/skylights, insulation, electrical, gas furnaces/water heaters and central A/C units are subject to a combined annual cap of $1,200

- Heat pumps, heat pump water heaters and biomass stoves/boilers have an annual cap of $2000

- Clean energy upgrades (solar panels, fuel cells, geothermal heat pumps) are not subject to a maximum annual cap, allowing you to potentially claim up to 30% of costs

Every homeowner’s tax situation is unique and we encourage you to speak with a tax professional about your eligibility on specific tax credits before committing to any home improvements.

This means that you can claim credits for multiple upgrades over a single tax year — up to a maximum of $3,200. This allows you to upgrade your home strategically and spread the work out over several years to optimize your energy efficiency in a way that fits your budget.

OPPD also has several related rebates under our Save Money, Save Energy program that can help you offset some of the up-front costs and still take advantage of qualifying Inflation Reduction Act tax credits for that year! As always, consult with an OPPD-certified Trade Ally and your tax professional before finalizing any home upgrades.

IRA Resources

Learn more about the IRA and its included upgrades by exploring the following sources:

Inflation Reduction Act of 2022

EnergyStar IRA Homeowner Tax Credit Guide

Internal Revenue Service IRA FAQ

Rewiring America

Text of the Inflation Reduction Act